Adjusting for inflation

Inflation adjustments added to your pension can help preserve your buying power throughout your retirement.

The Teachers' Pension Board of Trustees (board) is dedicated to ensuring cost-of-living adjustments (COLAs) are sustainable over the long term.

Each year, the board carefully considers various factors to decide whether to approve a COLA – and, if so, its value.

Your future pension payments may increase annually thanks to COLAs. A COLA is an increase in pension payments that may be added to retired members' pensions in January to help offset the effects of inflation.

COLAs are not a guaranteed benefit, so you may not receive a COLA each year, and the amount may change from year to year. However, once you receive a COLA, it becomes part of your lifetime monthly pension. When approved, COLAs are also applied to the bridge benefit and temporary annuity portion of your pension, if applicable.

Factors the board considers to support the sustainability of future COLAs are outlined in the plan rules and funding policy and include:

- The cost of providing COLA (cannot exceed the funds in the inflation adjustment account)

- The amount of COLA (cannot be higher than the increase in the Canadian consumer price index (CPI) September to September)

- The level of COLA that the actuary determines the plan can afford to pay on a sustainable basis (an actuary is a professional with specialized training in financial modelling, the laws of probability and risk management)

To understand how this works, it helps to know that your pension is funded through two accounts: the basic account and the inflation adjustment account.

Basic account = funding for basic lifetime pension

Member and employer contributions and investment returns fund the basic account. Your basic pension is paid each month from funds in the basic account.

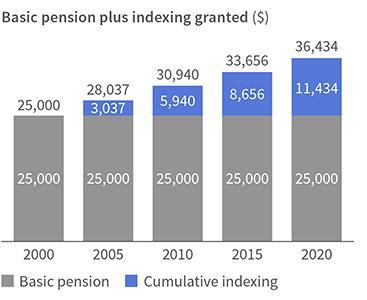

Source: Pension Corporation Finance 2020

Inflation adjustment account = funding for COLAs

The inflation adjustment account is separate from the basic account. Member and employer contributions and investment returns also fund this account. COLAs are not guaranteed; the board decides whether to approve a COLA based on a number of factors including the funds available in the inflation adjustment account.

After a COLA is approved, funds from the inflation adjustment account are transferred to the basic account and applied to your lifetime pension, bridge benefit and temporary annuity, if applicable.

The board is dedicated to ensuring COLAs are sustainable over the long term to equitably support all members – past, present and future.

Traditionally, COLAs have been granted for the full CPI increase each year. However, the board may grant a COLA that is lower than the CPI increase.

Calculating the COLA

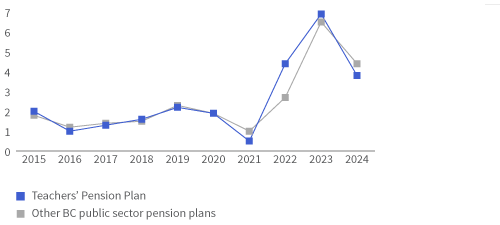

You may have noticed some pension plans have COLA amounts that are different from yours. That’s because BC public sector pension plans have different ways of calculating the COLA. In general, different calculation methods generate different annual COLA amounts. The good news is that no method produces results that are consistently higher or lower than the others over multiple years.

Calculation methods

The COLA is calculated using monthly rates from the Canadian consumer price index. Your plan uses the difference between September CPIs. With this method, the COLA is based on the percentage change between the current year’s September CPI and the previous September’s CPI.

Other BC public sector pension plans may use the annual percentage change in the average CPI. With this method, the COLA is based on the annual percentage change in the 12-month average CPI from one year to the next. Each year, that average, from November to October, is compared to the average for the 12-month period that came before it. The difference between the two 12-month periods becomes the COLA.

Example

In some years, one method generates a higher COLA; in some years, the other method generates a higher amount.

COLA methodologies comparison (%)

Because of COLA/inflation adjustment caps, some plans did not grant the full COLA/inflation adjustment amounts determined by their plan's methodology in certain years.

COLAs add up over time. For example, if you started receiving an annual pension of $25,000 in 2000, your annual pension in 2020 would be $36,434 as a result of COLAs approved by the board.