How we calculate your pension

We calculate your pension based on your years of pensionable service and the average of your five highest years of salary.

Your pension is based on the number of years you contributed to the plan and the average of your five highest years of salary (not necessarily the last five years). If you worked part time, your highest years of salary are calculated as if you were working full time.

We calculate your lifetime pension using two pension formulas: one for service earned up to and including December 31, 2017, and one for service earned on and after January 1, 2018. If your service spans this period, we will add the two amounts together to calculate your lifetime monthly pension payment.

The following formulas show how we calculate your pension based on a single life pension with no guarantee, assuming you retire at or before the normal retirement age.

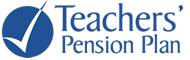

For pensionable service earned up to and including December 31, 2017

We use the following formula to calculate your basic pension:

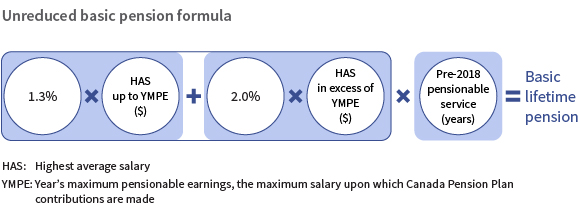

If you are retiring before the normal retirement age of 65, we add a bridge benefit to this amount, payable until you turn 65 or die, whichever comes first. We calculate the bridge benefit as follows:

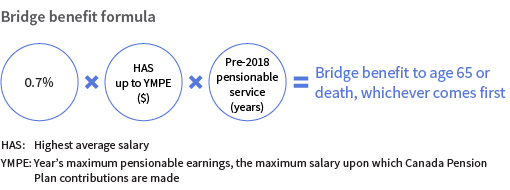

For pensionable service earned on or after January 1, 2018

We use the following formula to calculate your pension:

Factors that affect your monthly pension payment

These basic pension formulas are based on a single life pension option with no guarantee. The actual monthly pension payment you receive will depend on several other factors, which may include:

- Your age when you retire, which may result in a reduced pension

- The pension option you choose

- The premiums you pay for voluntary retirement health coverage through the group benefit plan

- Any legally required deductions, such as income tax

- Your contributory service

After you retire, your monthly pension payment may increase if there is an annual cost-of-living adjustment (COLA). This adjustment may be added to your pension (and to your bridge benefit and temporary annuity, if applicable) to help them keep pace with increases in the cost of living over time.

COLAs are not guaranteed; they are based on changes in the Canadian consumer price index and the funds available in the inflation adjustment account of BC’s Teachers’ Pension Plan.

Once a COLA has been granted, it becomes part of your lifetime pension for all subsequent years. However, the portion of a COLA granted on a temporary annuity or bridge benefit will end when the annuity or bridge benefit ends.