Guide for plan members

Teachers' Pension Plan is committed to helping you make the most of your pension. This guide is a provincial legislative requirement. Please use the links at right to explore the topics most relevant to you.

When you can retire

The age at which you apply for your pension will affect the amount of your lifetime monthly pension payment.

The normal retirement age for members of BC’s Teachers' Pension Plan is 65 and the earliest retirement age is 55. As required by the Income Tax Act, you must begin receiving your pension no later than December 1 of the year in which you turn 71, even if you are still working.

Qualifying for an unreduced pension

If you retire before your normal retirement age, your age at retirement and years of contributory service will determine if you are eligible for an unreduced pension.

If you do not apply to start your unreduced pension when you are eligible, you will not be entitled to have your pension backdated to a previous date. You are responsible for choosing the date your pension will start and you must apply to start your pension.

Although you can apply for your pension as early as age 55, your pension, including the bridge benefit (if applicable), will be reduced if you do not meet certain criteria.

For pensionable service earned before January 1, 2018, your pension will not be reduced at the date of your retirement if you are:

- Age 55 to 59 and your age plus years of all contributory service totals at least 90 (known as the rule of 90)

- Age 60 to 64 with at least two years of contributory service

- Age 65 or older (no minimum contributory service requirement)

For pensionable service earned on and after January 1, 2018, your pension will not be reduced at the date of your retirement if you are:

- Age 55 to 60 with at least 35 years of contributory service

- Age 61 to 64 with at least two years of contributory service

- Age 65 or older (no minimum contributory service requirement)

To learn more about how the changes may affect your pension, sign in to My Account and use the personalized Pension Estimator to find out what your monthly pension might be based on your salary and years of service.

You may want to talk to an independent financial advisor about which start date is best for you and your situation.

How we calculate your pension

Your pension is based on the number of years you contributed to the plan and the average of your five highest years of salary (not necessarily the last five years). If you worked part time, your highest years of salary are calculated as if you were working full time.

We calculate your lifetime pension using two pension formulas: one for service earned up to and including December 31, 2017, and one for service earned on and after January 1, 2018. If your service spans this period, we will add the two amounts together to calculate your lifetime monthly pension payment.

The following formulas show how we calculate your pension based on a single life pension with no guarantee, assuming you retire at or before the normal retirement age.

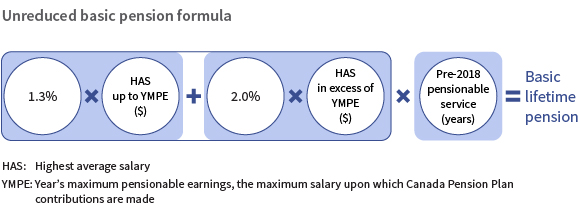

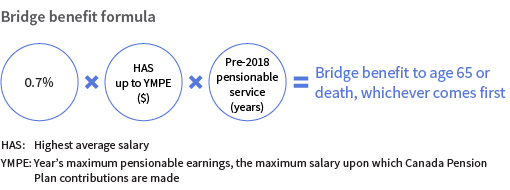

For pensionable service earned up to and including December 31, 2017

We use the following formula to calculate your basic pension:

If you are retiring before the normal retirement age of 65, we add a bridge benefit to this amount, payable until you turn 65 or die, whichever comes first. We calculate the bridge benefit as follows:

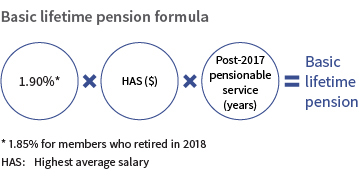

For pensionable service earned on or after January 1, 2018

We use the following formula to calculate your pension:

Factors that affect your monthly pension payment

These basic pension formulas are based on a single life pension option with no guarantee. The actual monthly pension payment you receive will depend on several other factors, which may include:

- Your age when you retire, which may result in a reduced pension

- The pension option you choose

- The premiums you pay for voluntary retirement health coverage through the group benefit plan

- Any legally required deductions, such as income tax

- Your contributory service

After you retire, your monthly pension payment may increase if there is an annual cost-of-living adjustment (COLA). This adjustment may be added to your pension (and to your bridge benefit and temporary annuity, if applicable) to help them keep pace with increases in the cost of living over time.

COLAs are not guaranteed; they are based on changes in the Canadian consumer price index and the funds available in the inflation adjustment account of BC’s Teachers’ Pension Plan.

Once a COLA has been granted, it becomes part of your lifetime pension for all subsequent years. However, the portion of a COLA granted on a temporary annuity or bridge benefit will end when the annuity or bridge benefit ends.

Calculating your reduced pension

If you decide to retire early and do not meet the criteria for an unreduced pension, your pension will be reduced. The bridge benefit, if applicable, will also be reduced.

The reduction amount is based on a combination of your:

- Age when you leave your job

- Contributory service

- Age when you start receiving your pension

Reductions are pro-rated by month for partial years.

The early retirement reduction rules are complex. If you are not sure which of the following scenarios applies to you, contact the plan to discuss your particular situation.

For pensionable service earned up to and including December 31, 2017

Unreduced scenario

Any one of the following:

- Retire between ages 55 and 59 and your age plus years of contributory service totals at least 90

- Retire between ages 60 and 64 with at least two years of contributory service

- Retire at age 65 or older

Reduction amount – none; you qualify for an unreduced pension

Scenario 1

- Retire before age 65

- Have less than two years of contributory service

Reduction amount – five per cent for every year you are under age 65

Scenario 2

- End employment between ages 55 and 60 and retire

- Have at least 10 years of pensionable service

- In the last 24 months of employment, have at least one of:

- 20 months of contributory service

- 10 months of pensionable service

Reduction amount – whichever calculation is lower:

- Three per cent for every year you are under age 60

- Three per cent for every year your age plus contributory service is less than 90

Scenario 3

Any early retirement scenario other than those described above

Reduction amount – whichever calculation is lower:

- Five per cent for every year you are under age 60

- Five per cent for every year your age plus contributory service is less than 90

For pensionable service earned on or after January 1, 2018

Unreduced scenario

Any one of the following:

- Retire between ages 55 and 60 with at least 35 years of contributory service

- Retire between ages 61 and 64 with at least two years of contributory service

- Retire at age 65 or older

Reduction amount – none; you qualify for an unreduced pension

Scenario 1

- Retire before age 65

- Have less than two years of contributory service

Reduction amount – 4.5 per cent for every year you are under age 65

Scenario 2

- Retire before age 61

- Have more than 2 but fewer than 35 years of contributory service

Reduction amount – 4.5 per cent for every year you are under age 61

Naming beneficiaries

Your pension is a secure lifetime source of income after you retire. In addition to the financial security it provides you, your pension may also provide financial care for your beneficiaries after your death. Your beneficiaries can be family members, friends, charities or organizations that are important to you.

If you die before you retire, BC's Teachers' Pension Plan will pay a death benefit to your beneficiary(ies).

If you die after you retire, the plan may pay a death benefit to your beneficiary(ies) based on the pension option you chose when you retired.

The beneficiary(ies) you name while you are working are entitled to a portion of your pension if you die before retirement. When you apply for your pension, you can name the same beneficiary(ies) or different ones.

It’s a good idea to talk with an estate planner, lawyer or financial adviser to determine the best choice for you when it comes to naming beneficiaries.

This video introduces you to the importance of nominating your pension beneficiaries.

There are two default beneficiaries: your spouse and your estate.

Your spouse

Your spouse is automatically your beneficiary when you die.

If they wish to give up their right to the death benefit they would normally receive when you die, your spouse must sign a waiver.

If you do not have a spouse, or if your spouse has waived their right to a death benefit, you can name other people, charities or organizations as your beneficiaries.

You can also name a trust as your beneficiary. This is helpful if your beneficiary is a minor at the time of your death or is not able to manage their own finances.

You can name one or more alternate beneficiaries for each beneficiary. If a beneficiary dies before you, the alternate beneficiary(ies) will receive the death benefit when you die.

Your estate

If you do not have a spouse and have not named a beneficiary, your estate is automatically your beneficiary when you die. Your executor will be responsible for distributing the death benefit. If you do not have a legal will, someone must apply to the courts to administer your estate.

You can also name your estate as your beneficiary. The death benefit will then be paid to your estate and distributed according to the instructions in your will.

Sign in to My Account to view your current beneficiary information.

If you are a member of more than one pension plan administered by BC Pension Corporation, you need to submit a separate nomination of beneficiary form for each plan.

Preparing for retirement

When it’s time to apply for your pension, you have some important decisions to make. These decisions will affect the financial future of you and your loved ones. Take time to review the available resources and gather the documents you’ll need.

Looking for more information? Visit the links in the Related Content box for more details on the topics in the checklist.

One year before you retire

□ Get a pension estimate. Use the Personalized Pension Estimator in My Account to explore your pension options instantly.

□ Take a webinar or online course. Approaching retirement is offered as a 75-minute instructor-led webinar or 45-minute online course.

□ Consider your beneficiaries. Think about who you will name as your primary beneficiary and alternate beneficiaries. Your spouse is automatically your primary beneficiary.

□ Learn about retirement health coverage. You can access extended health care and dental coverage through the plan when you apply for your pension.

□ Maximize your pension. You may be able to transfer prior service from another plan or buy back service for an approved leave. There are deadlines to apply.

□ Confirm your age and identity. Submit verification documents to the plan in My Account. Go to Personal Information in your My Account profile.

- If you changed your name, submit documents to show proof of your new legal name.

□ Tell us if you have or had a spouse. We need to know if you have a current or former spouse. Go to the Spouse Information section in your My Account profile.

□ Tell us how to divide your pension. This is necessary only if you are separated from a spouse and they have a claim to a portion of your pension. Upload your separation agreement or court order in your My Account profile.

□ Contact Service Canada. You may be eligible for the Canada Pension Plan and/or old age security pension. These may provide other sources of retirement income. Find out if you’re eligible and how to apply.

□ Book a one-on-one appointment with us. Ask a trained representative questions you have about your individual situation.

□ Talk with an independent financial advisor. They can help determine which pension option is best for your financial situation.

□ Inform your employer. Contact your employer(s) in writing to arrange your last day of paid employment. You must fully terminate all employment in the Teachers' Pension Plan in order to collect your pension

90 days before your pension effective date

Your pension effective date is the month you want to begin receiving your pension. The earliest you can apply for your pension is 90 days before your pension effective date. It's a good idea to apply as soon as you're able.

Occasionally, pension applications may take longer to process than usual. Please submit your application at least 30 days before the month you'd like to retire.

Apply for your pension online in My Account. Or request a paper application package. Visit Applying for your pension, under Pension Basics for next steps.

Guide for plan members: links to additional information

How pension contributions work

Taking time off work and buying service

How to apply for disability benefits

Beneficiaries and your pension

Retirement health coverage and you