How the plan decides where to invest

Investing for such a large plan is complex. Policies help the Teachers' Pension Board of Trustees decide how and where to invest.

Measurement

The board monitors progress in two ways: by comparing results to a market benchmark and an investment return target, and by ensuring investments are on track through regular actuarial valuations.

Benchmarks

A benchmark is a standard used to measure the performance of an investment or a portfolio. The plan uses benchmarks for total investment returns over 1-year, 5-year and 10-year periods. It also sets benchmarks for specific types of asset classes, such as real estate.

The Statement of Investment Policies and Procedures identifies the benchmarks. These include broad markets such as Canadian and U.S. equities which trade on the TSX, and NYSE, NASDAQ and Dow, respectively.

Investment return target

The board expects that some years will have lower returns. That’s why it looks not only at quarterly and annual returns but also at long-term performance.

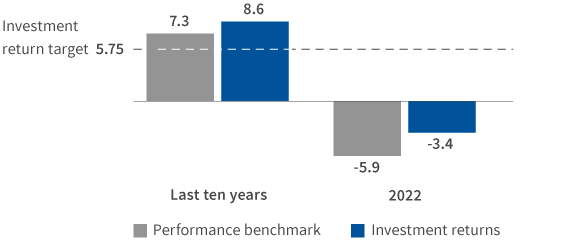

The plan’s long-term investment return target is 5.75 per cent. While annual investment returns vary, this target is used to measure the plan’s ability to meet its pension obligations over the long term.

The 2022 annual report shows that over the previous 10-year period, the plan’s investments have earned more than the investment return target.

Investment return vs benchmark (%)

Actuarial valuations

Your plan uses actuarial valuations to measure the plan’s long-term financial health and ability to pay pensions. Every three years, an independent financial expert (called an actuary) performs a valuation. This valuation shows whether the plan is on track to meet its goals. As part of each valuation, the actuary defines an assumed long-term rate of investment return for the plan.

Before each actuarial valuation, the board reviews the funding policy. This policy provides guidelines for managing the financial position of the plan.