A diversified approach

Diversification is an important investment tool for managing risk. A mix of assets helps the board secure the basic pension for every member.

To protect the sustainability of your pension, the plan’s investments are broadly diversified. That means the plan is invested in a range of industry sectors, geographic regions and asset classes.

Asset classes are categories of investments, including:

- Fixed income (investments that pay investors regular interest or dividends)

- Mortgages

- Public and private equity (company shares sold to the public or to private investors, respectively)

- Real estate

- Infrastructure (systems and structures that provide communities with resources like water, energy or transportation)

- Renewable resources (natural resources that aren’t depleted by use, such as solar and wind energy)

Why diversification matters

Diversification is an important tool for managing risk. Because the plan’s investments are diversified, losses in any one asset class pose less of a risk to the plan’s overall investment performance. This allows the plan to earn a higher return with lower risk compared to a less diversified fund.

The plan’s asset mix policy

The plan’s primary goal is to secure the basic pension for every member. To support this goal, the Teachers’ Pension Board of Trustees sets a long-term asset mix policy. This policy outlines how much money the plan can allocate to each type of asset.

The plan’s asset mix policy focuses on private equity, regulated utilities, renewable resources and real assets.

Real assets are assets that physically exist and have an inherent value, like office buildings or highways. They typically increase in value over time, provide income and help protect against inflation. They also tend to be less volatile than public markets. Direct investments in real assets allow BCI, the plan’s investment manager, to influence the strategic direction of these companies with the aim of creating long-term value for the plan.

Investment holdings

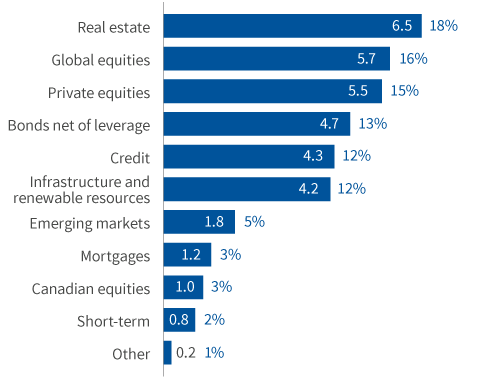

The breakdown of the plan’s investment types shows how the portfolio is diversified.

Investment holdings—market value ($ billions)

as at December 31, 2022