Tax information for retired members - Teachers

Tax information for retired members

Your pension is taxable income. We will deduct federal and provincial income tax from your monthly pension payment.

Deductions from your monthly pension payment

Your pension is taxable income. This means we are required by law to deduct income tax from your gross monthly pension payment. The amount we deduct is based on a single-person rate and the income you receive from BC's Teachers' Pension Plan. Your other sources of income may have tax deducted at a different rate.

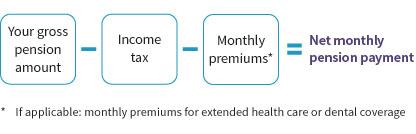

The net monthly pension payment is calculated as follows:

The amount of income tax we deduct from your monthly pension payment depends on where you live. Each province and country has its own tax rate. We use the tax rate for your province of residence or, if you live outside Canada, the tax rate for your country of residence, as specified by Canada Revenue Agency (CRA).

Note: The amount we deduct from your monthly pension payment assumes your pension is your only source of income. If you have other sources of income, such as benefits from the Canada Pension Plan or old age security, this could put you in a higher tax bracket and result in more taxes owed.

External link for retired member tax information

Learn more about pension income splitting on the Canada Revenue Agency website cra-arc.gc.ca